Mileage Reimbursement Rate 2024 Nz

Mileage Reimbursement Rate 2024 Nz. The table of rates for the 2021/2022 income year for motor vehicle expenditure claims. The claim will be limited to 25% of the vehicle running costs as a business expense.

The claim will be limited to 25% of the vehicle running costs as a business expense. Ird mileage reimbursement rates in new zealand.

What Is The 2024 Federal Mileage Reimbursement Rate?

To help in calculating an employee’s reimbursement when they use their private vehicle for work.

In Accordance With S De 12 (4) The.

You can obtain this online at.

This Gives Employers Four Options When Reimbursing Staff For The Business Use Of A Private Vehicle:

Images References :

Source: dorettewjobie.pages.dev

Source: dorettewjobie.pages.dev

Canada Kilometer Reimbursement 2024 Cati Mattie, You can obtain this online at. If you are a sole trader or qualifying close company and use the kilometre rate method to claim business vehicle costs, this new rate applies for the 2022 year,.

Source: hrwatchdog.calchamber.com

Source: hrwatchdog.calchamber.com

Mileage Reimbursement Rate Increases on July 1 HRWatchdog, However, you may be asked to substantiate the percentage claimed. Ird mileage reimbursement rates in new zealand.

Source: otheliawerma.pages.dev

Source: otheliawerma.pages.dev

Irs Per Diem Rates 2024 Mileage Dory Nanice, However, you may be asked to substantiate the percentage claimed. New zealand's inland revenue (ir) has just released its vehicle kilometre (km) rates for the 2021 income year, and it’s not.

Source: www.hrmorning.com

Source: www.hrmorning.com

2023 standard mileage rates released by IRS, The table of rates for the 2021/2022 income year for motor vehicle expenditure claims. The claim will be limited to 25% of the vehicle running costs as a business expense.

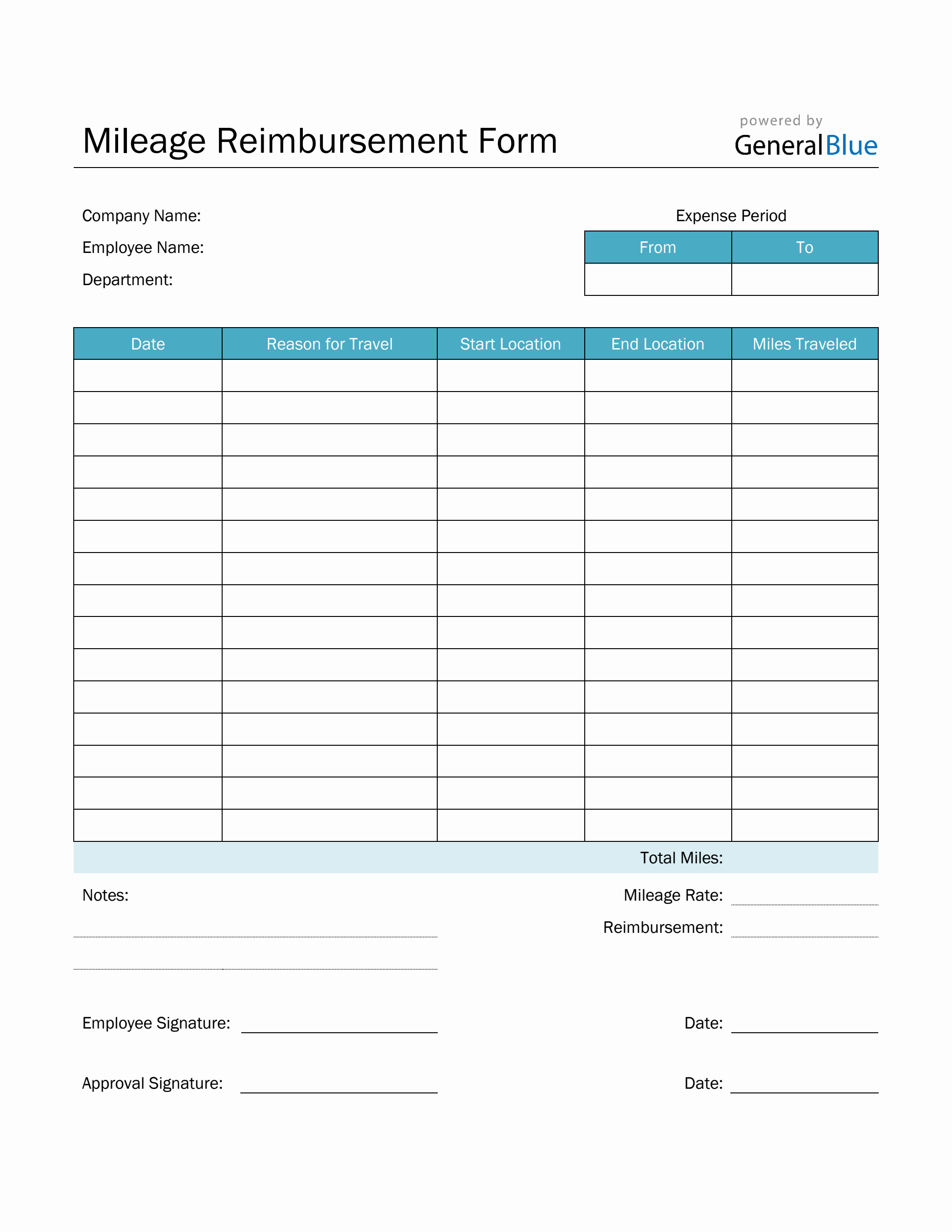

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in Word (Basic), Ird mileage reimbursement rates in new zealand. New zealand's inland revenue (ir) has just released its vehicle kilometre (km) rates for the 2021 income year, and it’s not.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, 2022 mileage reimbursement rates published. Inland revenue has advised the new mileage rate for motor vehicles is 77 cents per kilometre.

Source: bookkeepingconfidential.com

Source: bookkeepingconfidential.com

Mileage Reimbursement Rate Increases Starting July 1 Bookkeeping, Inland revenue has advised the new mileage rate for motor vehicles is 77 cents per kilometre. New zealand's commissioner of inland revenue is required to regularly set kilometre (km).

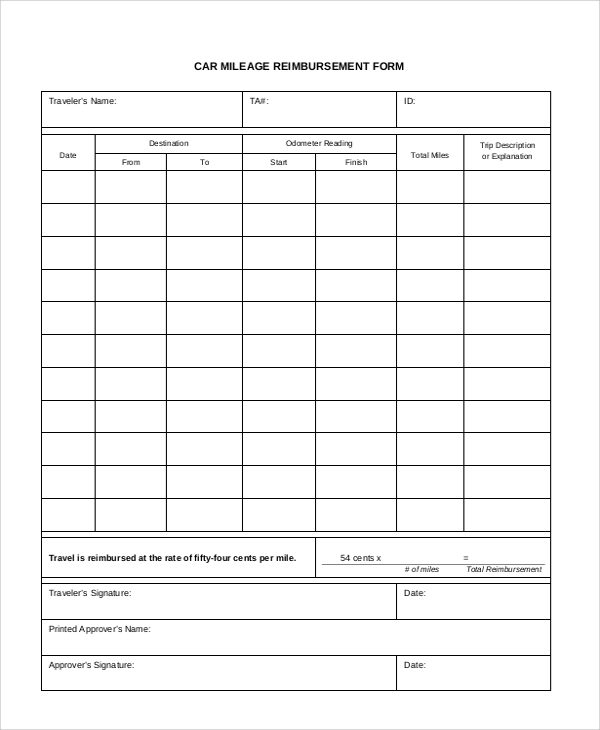

Source: irs-mileage-rate.com

Source: irs-mileage-rate.com

Car Mileage Reimbursement Form IRS Mileage Rate 2021, If you have already filed your 2023 income tax return, and relied on the 2022 kilometre rates, depending on the amount of the difference between the two amounts. Ird mileage reimbursement rates in new zealand.

Source: climate-pledge.org

Source: climate-pledge.org

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, Deloitte us | audit, consulting, advisory, and tax services However, you may be asked to substantiate the percentage claimed.

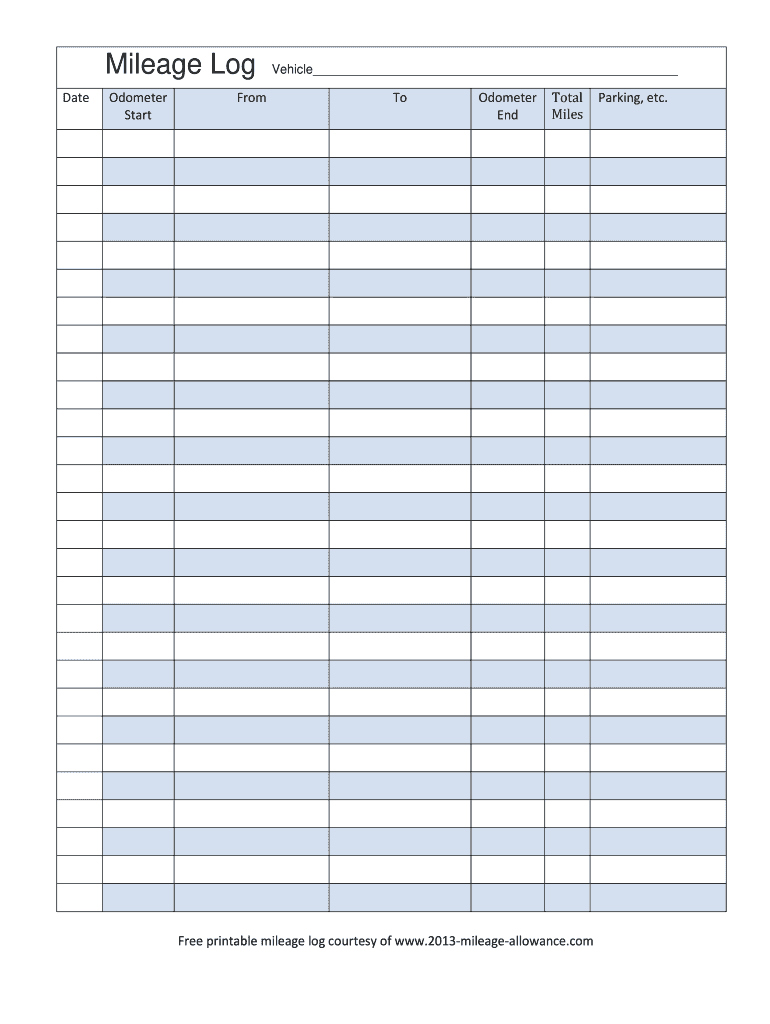

Source: printableformsfree.com

Source: printableformsfree.com

Free Printable Mileage Reimbursement Form Printable Forms Free Online, If you have already filed your 2023 income tax return, and relied on the 2022 kilometre rates, depending on the amount of the difference between the two amounts. According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs.

Actual Expenditure Incurred By The Employee;

According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs.

Ird Mileage Reimbursement Rates In New Zealand.

Commissioner’s statement on using a kilometre rate for employee reimbursement of a motor vehicle.